Unconsciously, the lively festive Spring Festival has come to an end. Just like people with a year of missing feelings, life joys and sorrows to go home to share with their families before the New Year, as early as before the New Year, some home appliance leading enterprises announced their own "report card" in the past year.

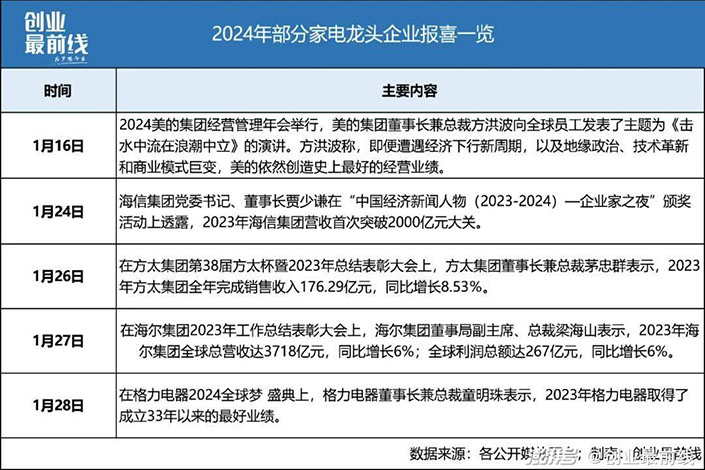

On January 16, Fang Hongbo, chairman of Midea Group, said that in 2023, Midea Group achieved the best operating performance in history.

On January 24, Jia Shaoqian, chairman of Hisense Group, said that Hisense Group's revenue exceeded 200 billion yuan in 2023.

On January 26, MAO Zhongqun, chairman and president of Fangtai Group, said that in 2023, Fangtai Group completed sales revenue of 17.629 billion yuan, an increase of 8.53%.

On January 27, Liang Haishan, vice chairman and president of Haier Group, said that Haier Group's global revenue in 2023 increased by 6% to 371.8 billion yuan, and its global profit increased by 6% to 26.7 billion yuan.

On January 28, Dong Mingzhu, chairman and president of Zhuhai Gree Electric Appliances Co., LTD., said that Gree Electric Appliances achieved the best performance in 2023 since its establishment 33 years ago.

2023 will be the first year after the outbreak, but it will also be a challenging year. The domestic home appliance market has entered the era of coexistence of increment and stock from a simple era of increment.

What is the core secret of the growth of the above head household appliance companies? They coincide in advance of the good news, does it mean that the home appliance industry as a whole is rapidly recovering? In the face of more and more "internal volume" of the home appliance market, where will the increment of the head enterprise come from in 2024?

1. Household appliances generally pre-happy

From an objective point of view, 2023 is a year full of challenges and opportunities for most industries, the statistics of the Ministry of Commerce show that the domestic appliance market has entered the era of coexistence of incremental and inventory from a simple era.

However, since the middle of January this year, some leading home appliance companies have "flexing their muscles" in different ways, which shows that they have achieved good results in the past 2023.

So, what is the secret of the growth of the above head household appliance companies?

In the view of "interface news · the forefront of entrepreneurship", this has a certain relationship with the hot sale of air conditioners in 2023. People familiar with the home appliance industry know that due to the concentrated release of the backlog of demand in the previous year (2022) and the high temperature weather in the South earlier in 2023 and the continued high temperature in the North China Plain and other reasons, the domestic air conditioning retail market has gone up all the way.

Reflected in the data, it is the increase of air conditioning retail sales. Aowei cloud network data show that in 2023, the domestic air conditioning market retail volume of 60.85 million units, an increase of 6.5%; Retail sales reached 211.7 billion yuan, up 7.5 percent year-on-year. As a head manufacturer, the United States, Gree, Haier and other natural benefits.

In addition, the performance of home appliance leaders has grown against the trend, but also thanks to the continuous breakthrough of its overseas business. Taking the United States and Haier Zhijia as an example, according to the financial reports of the two companies, the overseas business revenue of the United States Group and Haier Zhijia in the first half of 2023 was 80.536 billion yuan and 66.917 billion yuan, respectively, with a year-on-year growth rate of 3.47% and 8.8%.

"The United States, Haier, Hisense and other head home appliance brands, due to the layout of overseas markets for many years, has accumulated many industry-related professionals, coupled with the continuous improvement of its overseas operating capabilities, and gradually entered the harvest period." In 2023, the growth of these head manufacturers in overseas markets is generally relatively good, they are outperforming the entire overseas market, and there are more leads." CAI Ling, GfK China's global home appliance strategy account director, said to "interface news and the forefront of entrepreneurship".

So, can the growth trend of the above head enterprises in 2023 continue in the New Year?

CAI Ling believes that although the home appliance market in 2024 is expected to be basically flat compared with 2023, he is still optimistic about the growth trend of some domestic head manufacturers.

"In recent years, the growth rate of Midea, Haier, Hisense and other enterprises is much higher than the average growth rate of the entire market. Moreover, they still have a lot of incremental space to explore, such as a brand in Russia, Europe, the Middle East and other countries do well, it can expand to its absence in Southeast Asia and other blank markets. In addition, these leading appliance manufacturers can take market share from other brands." CAI Ling analysis said.

2. The overall recovery of the home appliance industry?

Home appliance giants have reported good news, does this mean that the home appliance industry as a whole is rapidly recovering?

From the current point of view, driven by home appliance leaders such as the United States, Haier, Gree, Hisense, and Fangtai, other small and medium-sized home appliance companies are still trying to keep up with the pace of recovery, and it will take some time for some business segments to pick up.

Take small kitchen appliances as an example, Owei cloud network data show that the overall retail volume of small kitchen appliances in 2023 is 265.43 million units, down 1.8% year-on-year; Retail sales fell 9.6% year-on-year to 54.93 billion yuan. Among them, online retail sales were 42.2 billion yuan, down 10.7% year-on-year; Offline retail sales were 12.7 billion yuan, down 6.0% year-on-year.

According to the forecast of Owei Cloud network, the home appliance market is still facing great demand growth pressure in 2024, and the annual retail sales scale increased only 0.7 percentage points year-on-year.

Xu Xingfeng, director of the Department of Market Operation and consumption Promotion of the Ministry of Commerce, previously said that to determine 2024 as the year of consumption promotion, we will do a good job of landing and blooming of various policies to stimulate potential consumption. On January 26, Wang Wentao, Minister of Commerce, said that a series of activities will be held to promote the "Consumption promotion Year" and promote the replacement of old appliances with new ones.

Peng Xiandong, general manager of GfK Zhongyi Kang Electric Division, said to the "interface news · Entrepreneurship forefront" that if the home appliance industry as a whole is rapidly recovering, then the relevant government departments do not need to introduce a series of policies to guide and support a rapidly recovering market. "Obviously, the recovery process of the overall home appliance market is still relatively slow." 'he said.

It should also be pointed out that the home appliance industry reshuffle will continue. Moreover, it is not just the simple squeezing of big manufacturers on small manufacturers, but also the "squeezing" of big enterprises. In other words, the phenomenon of "big fish eat small fish" and "big fish eat big fish" will continue to play out.

Therefore, in 2024, various internal volumes such as low prices, marketing, and services among home appliance companies will not be reduced, but will be sustained and normalized.

3. Where will the increase in 2024 come from?

In the face of the increasingly "internal volume" of the home appliance market, the "first growth curve" of enterprises has generally peaked. For leading companies in the industry, it is imperative to seek a second growth curve.

So, in the New Year, the United States, Haier, Gree, Hisense, Fang Tai and other head brands will find increment from where? "Interface news · The forefront of entrepreneurship" believes that new increments can be sought from four aspects: First, from the high-end market to find incremental.

As we all know, compared with the high-end market, the competition in the low-end market is more intense, in the low-end market, the head brand will face more competitors, and it is undoubtedly more difficult to get growth from here.

Moreover, the high-end market has a strong resistance to economic cyclicality, and it is also the only way for enterprises to obtain brand premium and product added value, and earn more profits. Therefore, in the increasingly fierce competition in the home appliance market, the high-end market is a new growth point that the head manufacturers can see.

Secondly, find increment from overseas market. In recent years, the United States, Haier, Gree, Hisense and other head brands in the deep cultivation of the Chinese market, but also in the overseas market.

From the public data, the international layout of some home appliance giants is not bad.

In the first half of 2023, the overseas business revenue of Midea Group and Haier Zhijia was 80.536 billion yuan and 66.917 billion yuan, respectively, accounting for 40.88% and 50.84% of their total revenue. In 2023, Hisense Group's overseas business revenue is 85.8 billion yuan, accounting for 42.6% of its total revenue.

It is not difficult to see that the overseas business of these three head brands has contributed significantly to their total revenue. Also because of the growth of overseas business revenue, thus driving their overall revenue growth.

"From our observation, the overseas market is one of the most important sources of growth for them [Midea, Haier, Hisense and other leading brands] in the next few years." Peng Xiandong said.

Third, from other industries other than home appliances to find incremental. In recent years, the head of household appliance brands are emphasizing diversified development.

According to the "interface news · the forefront of entrepreneurship", the current Midea has expanded its business to smart home, smart building, smart transportation, smart manufacturing, logistics, supply chain and other industries, Gree's diversified business has covered CNC machine tools, robots, photovoltaic and other emerging fields. Hisense has expanded its business to other industries such as smart medical, integrated circuit, smart transportation, smart city, optical communication, and automotive electronics.

From the point of view of public data, the diversified performance of some of the above enterprises is also commendable. Taking Midea as an example, in the first three quarters of 2023, the company's new energy and industrial technology revenue was 21.3 billion yuan, an increase of 25%. Smart building technology revenue was 21.2 billion yuan, up 19% year-on-year; Robotics and automation revenue was 22.9 billion yuan, up 17% year on year.

Finally, from the home appliance market to find incremental. We know that the set of home appliances refers to meet the needs of a certain scene or object under the premise of a number of different functions of the product, these products or have a unified design style, or through the interconnection can be unified control of smart home appliances, can be well integrated into the overall home environment, including the kitchen, living room, bedroom, the whole house and other scenes in the one-stop home appliance solution.

Home appliances are usually sold as sets, which increases the overall customer unit price compared to previous single unit sales. It is worth noting that with the continuous development of integrated home improvement, suite products have gradually become a popular choice for consumers. According to the 2022 home appliance market statistical report previously released by GfK, 56% of users will consider directly choosing complete appliances.

In addition, due to the particularity of its products, home appliances can improve the profit margin of enterprises. Moreover, the sales of home appliances advance to the user's decoration stage, which can seize the core needs of users in advance and seize market share.

Therefore, the system of home appliances has a large market expansion space, is expected to become a new track for home appliance leaders to open up performance growth.

4. Conclusion

Although some home appliance leading enterprises have reported good news, but this does not mean that the home appliance industry as a whole is rapidly recovering. Objectively speaking, the home appliance market is still facing great demand growth pressure in 2024.

However, in our view, with the increasingly mature home appliance industry, the United States, Haier, Hisense, Fang Tai and other head manufacturers with leading manufacturing level, diversified products and services, rich R & D and sales channel resources and scale advantages, market share will further gather to them.

Therefore, it is foreseeable that the growth momentum of some head household appliance brands in 2023 will be likely to continue in the New Year.

* Note: The drawings and illustrations in this paper are from the map network, based on VRF protocol.