The long-dormant home appliance market has been reactivated.

On February 23, the Central Financial and Economic Commission meeting proposed to promote a new round of large-scale equipment renewal and consumer goods to replace the old policy, including the focus of home appliances and automobiles, as one of the four pillars of the consumer market, home appliances industry ushered in a new historical opportunity.

Slowing Growth in the Home Appliance market

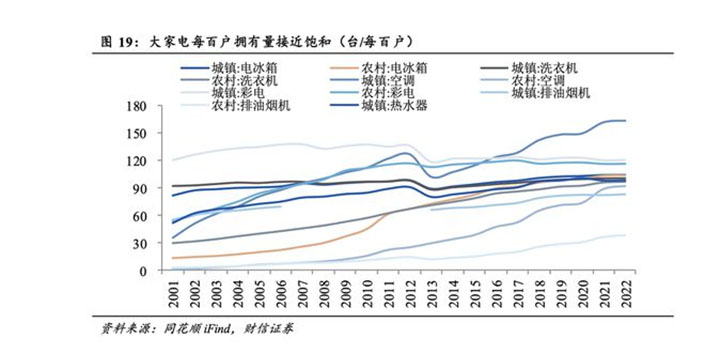

The home appliance market covers a variety of categories including black, white (such as air conditioners, refrigerators, washing machines), kitchen appliances and small appliances. However, with the slowdown in the pace of urbanization, since 2019, the market has entered the stage of stock competition from the incremental stage, the new demand has begun to reduce, the growth of the industry has been limited, and the development speed of the home appliance industry has entered a relatively stable development period.

In 2023, the total retail sales of China's home appliance market reached 824.5 billion yuan, but the annual growth rate was only 3%, which did not meet the expected growth.

From the perspective of domestic demand, the growth of the home appliance industry is closely related to the real estate market. In addition, the slowdown in population growth has also intensified the challenges of the home appliance consumer market, resulting in a downturn in the entire home appliance market. In the context of uncertainty in the market economy, consumers' purchase willingness has declined, even if home appliance manufacturers have implemented price cuts and promotion strategies, market demand is still difficult to significantly increase.

According to industry insiders, prices of mid - and low-end home appliances such as air conditioners, refrigerators and televisions have generally dropped by 100 to 500 yuan since mid-2023, while prices of high-end products have dropped by 20 percent.

On the external demand side, the interest rate hike policy in the European and American markets has weakened the purchasing power of durable consumer goods, while the decline in consumer confidence has also put pressure on the export of China's home appliances. Under the multiple challenges, the activation of the consumer market has become a key issue facing the current home appliance industry, at this time the launch of the "old for new" policy can be said to be the right time, electric technology believes that this will become an important measure to stimulate the market vitality and drive the home appliance industry out of the trough.

Activate the Home Appliance market

Looking back at history, "old for new" has repeatedly become a key factor in activating the home appliance market in the past.

In 2009, the country successfully resisted external economic shocks and activated the domestic market through the strategy of "sending home appliances to the countryside" and "exchanging old for new".

Under the promotion of this policy, from June 2009 to 2011, the central finance allocated a total of about 30 billion yuan of subsidies for replacing old appliances to local governments. Driven by this policy, color TVS accounted for 45 percent of the sales structure, becoming the biggest beneficiary, while sales of air conditioners, refrigerators, and washing machines were also more balanced, accounting for 13 percent, 15 percent, and 16 percent, respectively.

According to the Ministry of Commerce data show that since the implementation of the policy on June 1, 2009, the home appliance replacement policy has promoted a total of 300.42 billion yuan of home appliance consumption, sold 81.296 million new home appliances, and recycled 83.733 million old home appliances. By 2011, 92.48 million new home appliances had been sold nationwide, directly driving more than 342 billion yuan of consumption.

Looking forward to 2024, with the gradual recovery of the macro economy and the promotion of consumption subsidies and trade-in policies in many places, the demand for home appliance renewal is expected to gradually pick up. According to the latest data, as of 2023, the number of major household appliances such as refrigerators, washing machines, and air conditioners has exceeded 3 billion units, showing huge demand and potential for replacement.

It is worth mentioning that the upgrading of the home appliance industry is not achieved overnight, which involves many aspects such as technological innovation and consumer preference changes. The development of the home appliance industry closely follows the dynamics of the consumer market and the real estate market, and is directly affected by macroeconomic and related policy adjustments. However, as the market gradually picks up and driving factors continue to increase, the long-term development prospects of the industry remain optimistic.

Since 2023, with the gradual relaxation of real estate regulation policies, the home appliance industry has ushered in new development opportunities. In particular, driven by the transformation of old residential areas, the change of policy orientation in the real estate market and the relaxation of purchase restriction policies in first-tier cities, the recovery momentum of the home appliance market will become increasingly obvious, especially in the field of color TV and kitchen appliances.

Zhang Jing, general manager of the Black electricity business unit of JD.com Home Appliances, said sales of color TVS increased by nearly 40% during the Spring Festival. The analysis pointed out that this not only marks the recovery of the market, but also indicates that the home appliance industry is about to usher in a new round of growth climax.

Technology Leaders will be the Big winners

Driven by policies, companies that adapt to rapid change and have the ability to innovate are most likely to become market winners. This includes home appliance manufacturers that are able to respond quickly to market demands and continue to introduce innovative products and services. In particular, those companies that are at the forefront of technological innovation, energy efficiency improvement and environmental standards, such as Midea, Haier, Gree, etc., will undoubtedly be in a favorable position to compete.

First, with the government's increasing emphasis on energy conservation and environmental protection, the demand for high energy efficiency of commercial and engineering equipment will usher in significant growth. Through energy efficiency diagnosis, product energy efficiency surveys and environmental protection tax incentives, local governments incentivize enterprises to upgrade equipment, thereby driving demand for high-standard energy-saving products. For companies that have long been committed to the research and development of energy-efficient technologies and products, this will undoubtedly enhance their competitiveness in the market.

In addition, the expansion of the home appliance product category, such as the inclusion of data center equipment and commercial kitchen equipment, as well as the enhancement of energy efficiency standards for air conditioners, freezers, heat pumps and other products, will further stimulate market demand, especially for enterprises that already have technological advantages in these areas. For example, Midea's strong market position in commercial equipment will gain more development opportunities due to the new regulations.

In the field of household appliances, as energy saving intelligence has become an updated trend, the energy saving requirements of government procurement have become increasingly stringent, which requires home appliance companies to continuously introduce smart home appliance products that meet the new energy efficiency standards to meet the needs of the market. The trade-in policy has played a significant role in promoting the sales of energy-saving and efficient products, bringing great opportunities for enterprises, especially in the field of products such as frequency conversion energy-saving air conditioners and smart washing machines.

Therefore, a new round of trade-in policies and new energy efficiency regulations will promote the home appliance industry to develop in the direction of higher energy efficiency and intelligence. This is a critical moment for industry leaders to leverage their long-term accumulation in energy efficiency and smart technology research and development to maintain a competitive edge and seize market opportunities. At the same time, this will also promote the upgrading of the entire home appliance industry, promote energy conservation and emission reduction and green development, which is consistent with the long-term development strategy of the country.

Driven by such a policy, enterprises that can follow the trend, constantly innovate and quickly adapt to market changes are expected to become market leaders. With the intensification of competition in the home appliance market, consumers' choices will be more diversified, and the competition between enterprises will become more intense. In the face of this upcoming competition, all electricity companies need to be prepared to seize every opportunity in the change.