I. Industry-related Definitions

outdoor illumination refers to lighting other than indoor lighting. Outdoor lighting requirements to meet the needs of outdoor visual work and to achieve decorative effects.

Outdoor lighting is used for outdoor lighting, such as parks, squares, street sides and outdoor advertising lights.

Outdoor lighting mainly includes: lawn lights, garden lights, tunnel lights, floodlights, underwater lights, street lights, wall washing lights, landscape lights, buried lights and so on.

Lamp description: lamp tray skeleton is made of high-quality steel, hot dip galvanized treatment, the sealing plate is made of aluminum plate. Fastener bolts and nuts are stainless steel.

2. Industry Market size

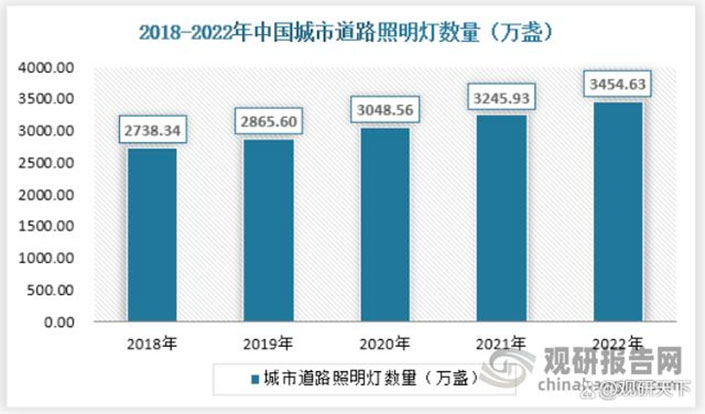

With the acceleration of urbanization, the demand for outdoor lighting in urban landscape, road lighting, commercial lighting, sports facilities lighting and other fields is increasing. According to the "China Urban Construction Statistical Yearbook" compiled by the Ministry of Housing and Urban-Rural Development, the number of urban road lights in China increased from 27.3834 million in 2018 to 32.4593 million in 2021, with an average annual growth rate of 5.77%, and the number of domestic urban road lights is expected to reach 34.5463 million in 2022. According to the average street lamp replacement once every 8 years in China, the number of new + replacement urban road lights in 2022 is about 5.1770 million.

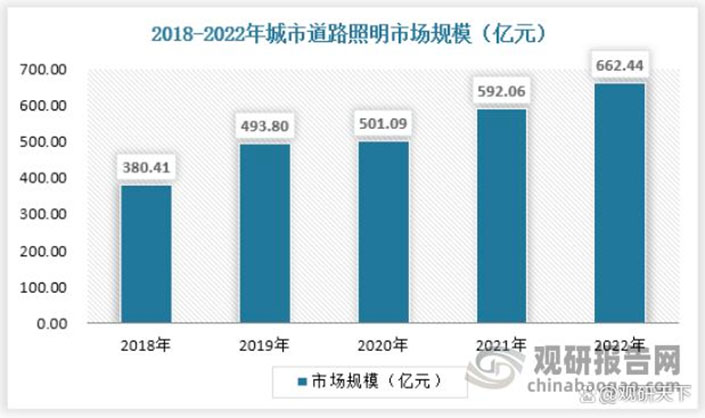

According to the average price of 12,800 yuan per set of street lights, the market size of China's urban road lighting in 2022 will be 66.244 billion yuan. In addition, in China's urban lighting investment, landscape lighting accounts for about 20% to 35%. It can be concluded that the domestic urban outdoor lighting market will be about 98.09 billion yuan in 2022.

Source: Guanyan World Data Center collation

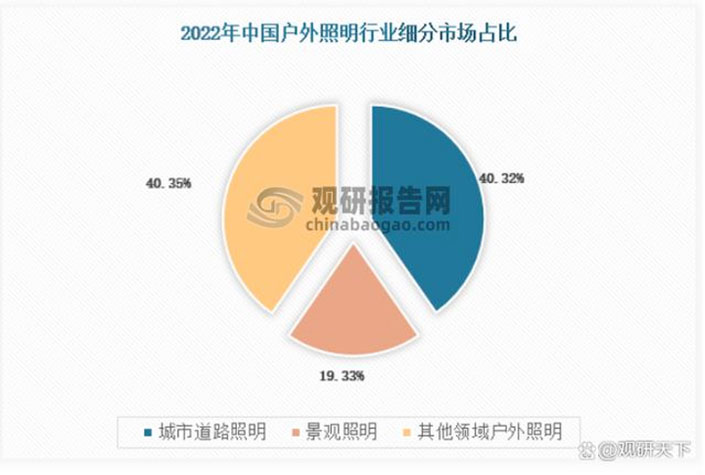

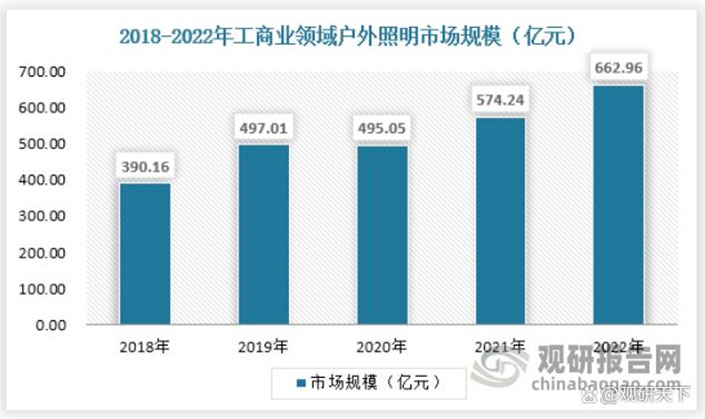

The outdoor lighting market in other industrial and commercial areas of China accounts for about 30% to 40% of the total outdoor lighting market, according to this proportion, it can be calculated that the market size of China's outdoor lighting industry in 2022 will be 164.305 billion yuan, as follows:

Source: Guanyan World Data Center collation

3. Industry Demand scale

The growth of the outdoor lighting industry is driven by a variety of factors, including accelerating urbanization and increasing investment in infrastructure construction. In the past decade, China's urbanization construction process has accelerated significantly, and the lighting environment requirements of all walks of life in the city have increased year by year, so China's outdoor lighting industry has maintained rapid development.

Source: Guanyan World Data Center collation

According to the data of the Ministry of Housing and Urban-Rural Development, the number of urban road lights in China has increased from 27.3834 million in 2018 to 3,2,459,300 in 2021. By 2022, the length of China's urban roads has exceeded 570,000 kilometers, and the length of roads equipped with street lamps is about 433,000 kilometers, with more than 34.4 million road lighting lights.

Source: Guanyan World Data Center collation

China's road street lamps are replaced once every 8 years on average, and with the rapid advancement of urbanization, urban lighting facilities have increased significantly. In 2022, the average annual number of new and replaced street lamps in China will reach more than 5 million sets, as follows:

Source: National Bureau of Statistics, compiled by Guanyan Data Center

4. Industry Segmentation Market

1. Urban road lighting

Urban road lighting refers to the lighting provided for urban roads. Urban road lighting can create a good visual environment for motor vehicle and non-motor vehicle drivers and pedestrians, ensure traffic safety, improve transportation efficiency and beautify the urban night environment. With the acceleration of urbanization and the continuous expansion of urban scale, the demand for road lighting has also increased. By 2022, China's urban road lighting market size is 66.244 billion yuan, as follows:

Fourth, industry segmentation market

2. Landscape Lighting

According to the different objects, urban landscape lighting can be divided into building (structure) landscape lighting, all kinds of square landscape lighting, commercial district landscape lighting, garden green landscape lighting, mountain water landscape lighting and other public facilities decorative lighting. With the development of tourism, more and more scenic spots and tourist cities need to attract tourists through landscape lighting. In 2022, China's outdoor landscape lighting market size is 31.766 billion yuan, as follows:

Source: Guanyan World Data Center collation

3. Other outdoor Lighting

Commercial and residential building lighting can improve the aesthetics and identification of buildings, helping to enhance the value of commercial and residential areas. Commercial buildings such as shopping centers, office buildings, hotels, etc., the demand for lighting is mainly focused on beauty, energy saving and intelligence. In 2022, the market size of China's industrial and commercial outdoor lighting industry is about 66.296 billion yuan, as follows:

Source: Guanyan World Data Center collation

Park outdoor lighting market demand shows a diversified trend, different types of parks, different application scenarios need different lighting solutions, such as office parks, business parks, industrial parks, ecological parks and so on.

The "14th Five-Year Plan for Digital Economy Development" clearly proposes to promote the digital transformation of industrial parks and industrial clusters, marking that parks have entered a new stage as an important part of new infrastructure construction and digital economy construction. Relying on the new generation of information technologies such as the Internet of Things, 5G, cloud computing, big data, and artificial intelligence, the park management platform and application are integrated to provide a digital environment for park management, industrial upgrading and enterprise operation, and form a digital ecology of the park where data elements continue to gather and technology scenarios continue to integrate. (WWTQ)